In a notable shake-up within the equipment rental industry, Herc Holdings outbid United Rentals to acquire H&E Equipment Services. United initially proposed a $4.8 billion all-cash deal at $92 per share, but Herc countered with a $5.3 billion offer, valuing each H&E share at approximately $104.89. This 14% premium secured H&E’s board’s approval, leading United to withdraw, citing financial discipline. The merger is expected to generate $300 million in annual synergies within three years while expanding Herc’s market reach with an additional 160 branches and 64,000 equipment units.

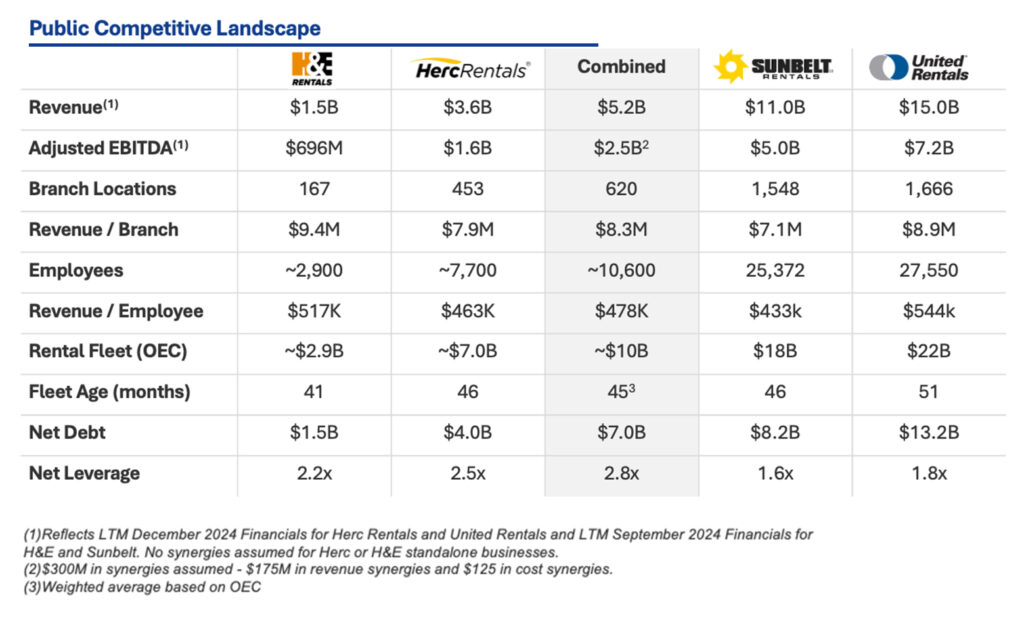

This deal significantly reshapes the competitive landscape. The combined Herc-H&E entity now generates $5.2 billion in revenue, solidifying its position as the third-largest player behind Sunbelt ($11.0 billion) and United Rentals ($15.0 billion). With 620 branches and over 10,000 employees, the company strengthens its ability to compete at scale. However, integration complexities and financial discipline remain critical as Herc absorbs H&E’s operations.